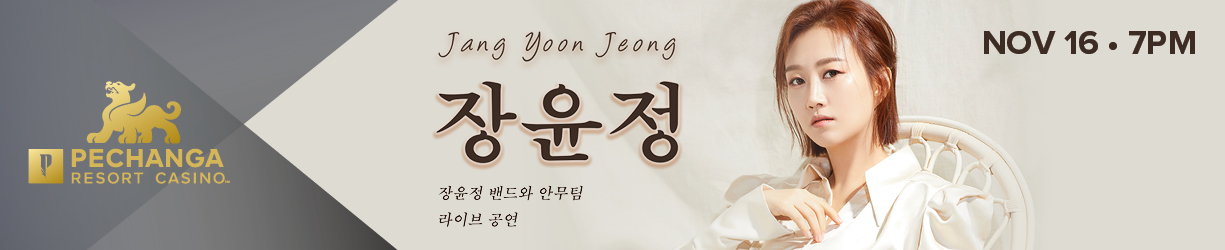

The Asian & Pacific Islander American Scholarship Fund (APIASF) has teamed up with Wong Fu Productions to bring an entertaining way for students to think about financial literacy and money management. Because lets be honest, students of this generation need to save as much money as possible.

APIASF is the largest non-profit organization devoted to providing college scholarships for Asian Americans and Pacific Islanders. The organization joined forces with Wong Fu Productions and Wells Fargo to create this adorably amusing short. “Save The Date” reminds us of the importance of responsible money management.

Here at Audrey, we completely understand the importance of saving up. We’ve come up with a few tips to make sure you avoid situations as awkward as this one. Trust me, you’ll thank us when the time comes.

1.) Beware the dangerous debit/credit card.

For some, debit and credit cards feel like a limitless source of funds. You don’t physically see your money leave your wallet, so its easy to lose track of how much you spend and how much you have left. Don’t fall into this trap. Stop by the bank and withdraw some cash so you can physically keep track.

2.) Utilize your kitchen.

You just came back from class, you’re exhausted and the last thing you want to think about is spending time cooking dinner. Fight the urge to pick up your phone and call for take out. Money spent on take-out and eating out adds up quick. Why not work on your cooking skills?

3.) Open up to your friends about your finances.

Don’t find yourself in the endless trap of making excuses every time your friends want to go out. You owe it to yourself to open and let them know that you’d prefer to stay in and watch a movie. In the end, you don’t seem anti-social and you get to spend time with friends.

4.) Shop smart.

There are plenty of ways to shop smart. Remember those things your mom used back in the day called coupons? Well they still exist and they work wonders. Also, avoid grocery shopping when you’re hungry. You’ll end up buying the whole store.

5.) Give yourself an allowance

I know you’re finally at that age where your parents don’t control and limit where your money goes, but nows the time to realize that your parents had the right idea. Start allocating money and stick to that amount. If you’ve only allotted $20 to buy yourself new clothes this month, then drop one of those cute tops and pick it up next month.

6.) Buy used textbooks

If you know you have no intention of keeping a book after you’ve finished a class, opting for a used book is always a good idea. Sometimes, these books are so well maintained that you wouldn’t even notice it was used. That, or the previous owner wasn’t too big a fan of studying.

7.) Open a savings account

Open a savings account and every time you have a little extra cash, move it over. A lot of times, this ends up being a life saver and you’ll be surprised how a little bit of cash every day could add up.

8.) Have someone keep you accountable.

Let someone know that you’re trying to save money. They can be the reminder you need when you’re in danger of spending too much.