Influence comes in many forms, from high-profile advocates who are shaping ideas on an international stage to local heroes who are breaking barriers and defying expectations in their own communities. In our inaugural series celebrating influential Asian American women, Audrey Magazine highlights eight newsmakers, activists, leaders and trailblazers who encourage us to pursue our dreams, explore the unknown, and stand up for those without a voice. Story by Ada Tseng.

CLICK HERE FOR MORE ASIAN AMERICAN INFLUENTIAL WOMEN!

CNBC unveils their new set on the floor of the NYSE with, from left, CNBC’s Brad Rubin, Carl Quintanilla, Melissa Lee, Jim Cramer and David Faber. PHOTO BY CHARLES SYKES/CNBC/ PHOTO BY VIRGINIA SHERWOOD

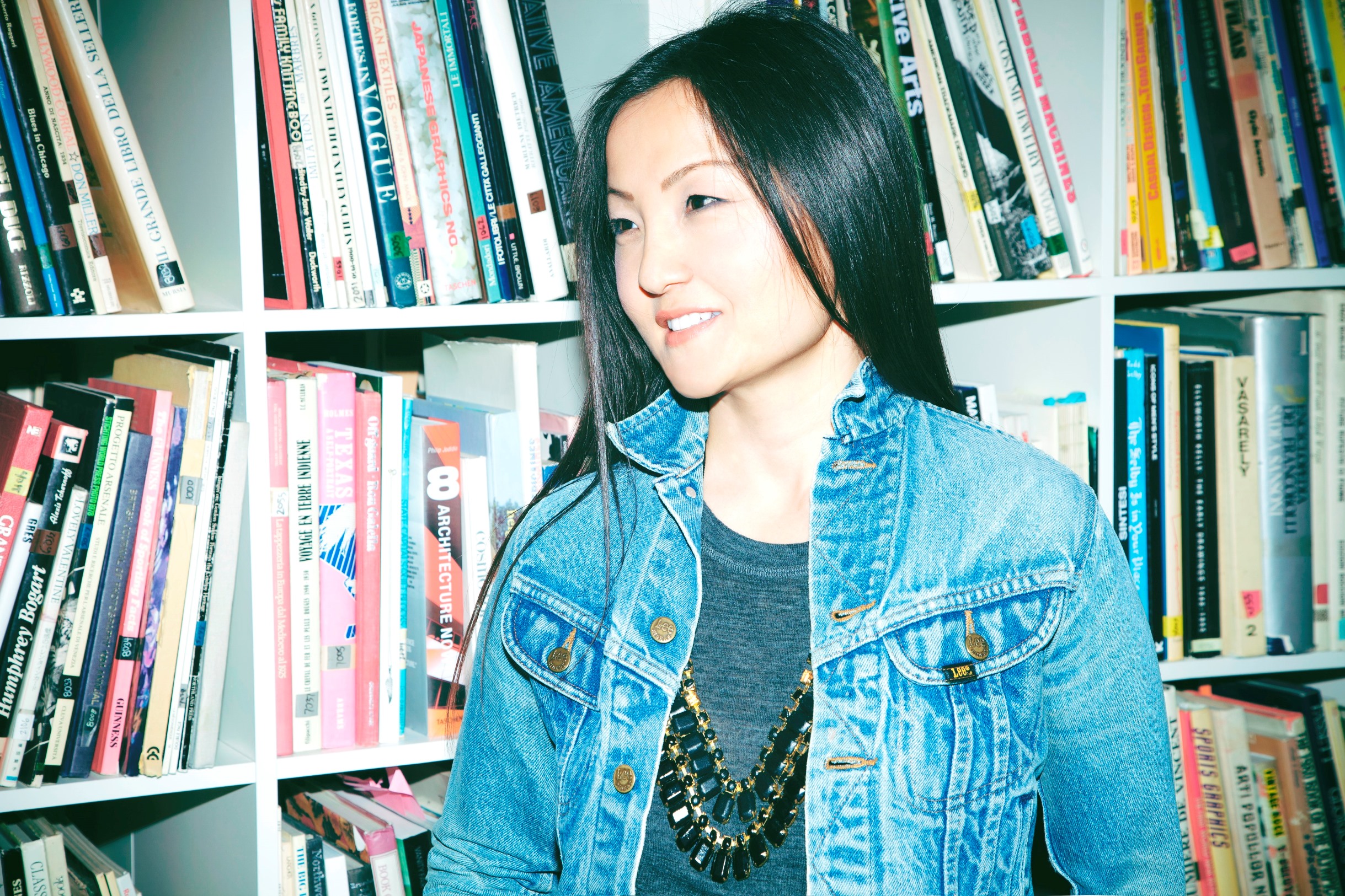

Melissa Lee has always been a fast talker. “There’s no explanation for it,” says Lee, laughing. “It’s not like I have a lot of kids in my family and I had to talk fast in order to get a word in edge-wise, but I think it’s just the nature of the business. I’m surrounded by people who talk fast all the time, because, as a trader, there’s not a lot of time to spare.”

CNBC’s fast-paced style is modeled after sports news, and Fast Money, which Lee took over in 2009, was conceived to be the SportsCenter of finance.

“Think of it like we’re all gathered at the end of a hard day’s work,” says Lee, continuing the sports analogy. “It’s been a hard game, we’re in the locker room, it’s a bit more informal, and now we can go deeper into the stock moves, the nitty-gritty play-by-plays, and what the strategy is for the next game, the next trading day.”

Most of the show is unscripted, and while there are often other women and minority panelists on her show, it’s not uncommon to see Lee at the center of her desk, surrounded by men, leading the conversation and asking mile-a-minute follow-ups to get to the truth of their opinions.

“Some people would say I’m too contrarian, but a large part of what financial journalists must do is take the other side so you can see both the merits and risks in investing,” she says. “Particularly when it comes to stocks, you don’t want to hear somebody talking up their book. You haven’t done your job if you’re not pushing back and really making sure their arguments are holding water.”

Lee didn’t grow up interested in finance, but her first journalism internship in college was at the New York Daily News, where she was placed in the business section.

“I saw that you covered the earnings that companies report, that there were analysts out there that covered stocks, and a whole new world opened up to me,” she says. “It became about how these stories affect people, because we’re talking about people’s 401(k)s, their college savings plans, their play portfolios. Whatever the reason, our job is to help people.”

This became abundantly clear during the 2008 financial crisis, when Lee found herself working around the clock and on weekends – rare in financial news.

“As a journalist, that was probably one of the biggest stories we’ll see in our lifetime,” says Lee. “It basically made us think everything we thought not possible was actually possible; that there would be no more Lehman Brothers or Bear Stearns, that Bank of America would buy Merrill Lynch. We also realized that at that very moment, people were making decisions based on what we’re reporting; what we’re saying on the air was moving the global markets, and there was a tremendous responsibility there.”

As an analyst on television, Lee hopes that she can help demystify the stock market for those who might find trading to be daunting, especially younger people who have just seen a generation lose a lot of money in stocks. She wants to encourage youth to save and take a longer-term view when it comes to their finances. Her own grandparents came to the U.S. from China and worked in a laundromat, but because they invested in businesses and the stock market, they were able to send five children to college.

“The stock market can be a tremendous tool to help build wealth in America,” says Lee. “I think you have to look at money as a vehicle for what you want to do in the future, and I hope we help people embrace it.

“One of the thrills of working at CNBC is that you have a voice,” she continues. “It’s playing in gyms, in banks, on trading floors, and in CEO offices. It’s a thrill when the CEO of General Electric tells me that when he’s in the office, he watches Fast Money at 5.”

WEB EXCLUSIVES

On how her first journalism job introduced her to financial news

I really had no exposure to the world of finance when I was growing up, but when I was in college, the first internship that I got was a print internship at the New York Daily News. They assigned me to the Business section, so that’s how I got my start. Looking back, it was pretty remarkable. Most of the staff were minority women, which is very unusual, and they turned me onto these various professional organizations like AAJA, which eventually helped me get more internships. I worked at Wall Street Journal for a summer, the Washington Post Business section for a summer, and back to Wall Street Journal. After that, I’ve always been geared toward business.

On being an Asian American woman in her industry

I don’t think you’re treated differently in terms of daily interaction at work, but you feel it in terms of the audience reaction. It’s always eye-opening to me, when I get a [racist] email or tweet. And it’s fine if they don’t like my personality, I completely accept that, but what’s shocking is that sometimes people hate you not for what you said, but they bring up me being Asian. Tell me you think I’m dumb, but don’t tell me you don’t like me cause I’m Asian American. That just reminds you that as far as we have come, there is still more work to be done. I hope that in some small way, I can be an example for other people out there.

Her best money advice

You should save as much as you can early on and put money in the stock market. I know that’s tough lesson, but time is on your side when you’re young. Save every penny you have. Don’t spend it on getting your first studio on your own, live with roommates. Don’t buy that handbag, don’t get the extra pair of shoes, don’t do the summer rental in the Hamptons. When you own your first apartment and sell it at a profit and buy a bigger apt, you’ll be much happier. When you have 401(k) you started at 21 instead of 29, that makes a big difference.

You have to have a longer-term view when it comes to money. You have to look at money as a vehicle for what you want to do in the future, so if you think, “By the time I’m 35, I want to have my own home, I want to take vacation, I want to not live off of credit cards and still have decent credit rating,” then you can’t spend every penny you make right now.

Who influences you?

That is tough, because there have been so many people along the way. One of the most influential conversations I’ve ever had in terms of shaping my career path was with this HR woman at CBS that I interviewed with. My absolute favorite show growing up was 60 minutes, and I wanted to intern there, and she said, “I can give you an internship here, you can answer phones and bring people coffee, but you’re not going to learn anything. You’re much better off going and working for a newspaper and learning how to report.” And that’s when I realized you have to think about the fundamentals first, and I’m a much better reporter today because of it.

Melissa Lee’s new CNBC documentary Rise of the Machines premieres September 18 at 9pm.

All around us, there’s a technological revolution underway powered by devices as small as a grain of rice. They are sensors, capable of tracking and recording everything we do. They’re in our smartphones, our cars, our appliances, even our bodies, and they’re connected to the Internet toshare information and make our world smarter. Virtually all products that use electricity – from toasters and coffeemakers to jet engines and MRIs – now have the ability to “talk” to each other, and to us. And, what they have to say is profoundly transforming our lives – the way we travel, treat disease, and enjoy our homes. Today, there are more devices than people connected to the Internet, and that number is expected to rise to 25 billion by 2015.

In this one-hour documentary, CNBC correspondent Melissa Lee experiences firsthand the impact of this brave new world – its promise and its perils – and discovers how the future of the Internet has already arrived. CNBC explores how the widespread availability of diagnostic sensors is not only changing healthcare and saving the lives of premature infants, but transforming industry and improving the safety and efficiency of our railways and jetliners. Lee takes a ride in a driverless car to see how cameras, radar and GPS are used in the quest to fill our freeways with autonomous cars and reduce the number of accidents. Viewers will go inside a home equipped with some 200 sensors which respond to the owner’s movements and daily habits. And CNBC travels to Rio de Janeiro, the world’s first “smart” city, in the spotlight as it prepares to host the 2014 World Cup and the 2016 Summer Olympics.

BUY THE FALL 2013 ISSUE FEATURING OUR WOMEN OF INFLUENCE HERE.